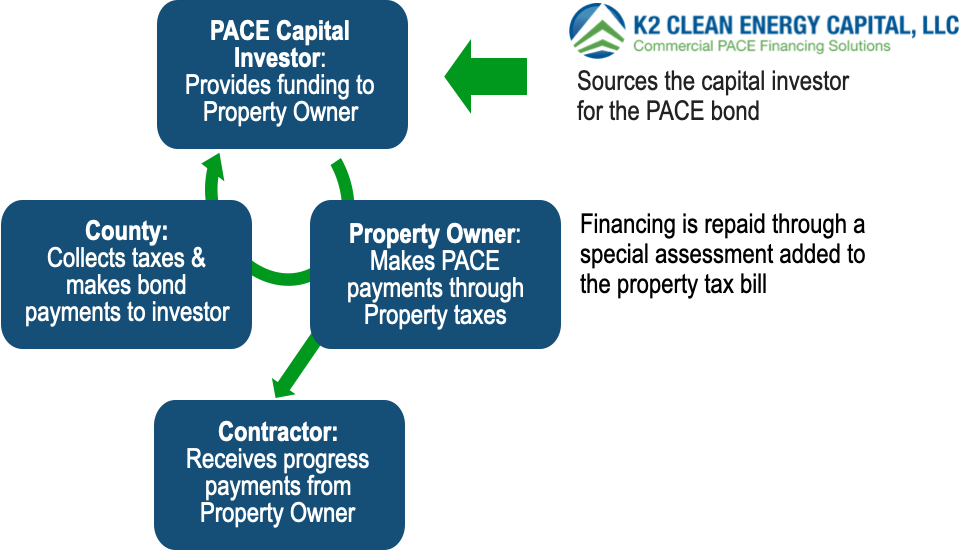

PACE is a state-legislated economic development program that enables long-term financing of renewable energy, energy efficiency, and water conservation projects for developers and property owners.

- PACE financing is secured against the property with a special assessment on the property taxes. Payments can be passed through to tenants with NNN leases, and the PACE assessment is automatically transferred to the new owner upon property sale.

- PACE Financing can be utilized on building Retrofit and New Construction projects as well as for Retro-financing of buildings completed within the last 3 years (in California).

- PACE Financing is typically limited to 25% LTV (as-stabilized), the total amount of eligible measures, and/or the total leverage on the project.

- K2 sources the funding for the PACE financing through its network of Commercial PACE investors which are private and/or institutional investors.

- PACE legislation has been enacted in over 35 states and 450 municipalities with the list rapidly expanding, and over 2500 commercial PACE deals have been successfully transacted. Contact us to find out more about your project location.

PACE Benefits

PACE financing is typically used to replace mezzanine debt or preferred equity but at a much lower cost and without any project control covenants. Other benefits of PACE financing include:

- Flexible terms up to (30) Years and fixed semi-annual payments (with property taxes)

- Non-recourse with No Personal Guarantees

- In the event of a defaulted payment, the only lien placed on the property is for the delinquent payment amount plus penalties and interest. The remaining balance of the assessment cannot be accelerated.

- Delinquent PACE payments, like delinquent property taxes, are senior to all other debt on the property. Thus approval from the debt lender is required. However, since most construction debt terms are +/-2 years and the capitalized interest period with PACE is up to 24 months, the risk to the lender is minimal- typically less than 2 payments.

- PACE financing is off-balance sheet since property taxes are part of operating expenses.

- Typically PACE funders do charge a prepayment penalty which steps down over time, however the PACE assessment can be paid back at anytime.